Djed powered by COTI

This deployment of Djed (which can be used at www.djed.xyz) relies on an implementation of the Minimal version of Djed in Plutus by Dr. Jean-Frederic Etienne, one of the co-authors of the Djed papers, who was responsible for the bounded model checking of the stability theorems. For reasons that are, to the best of our knowledge, not publicly known, the implementation departed from Djed's original aim of being an autonomous stablecoin. Aspects such as transaction batching, the oracle and contract updates are centrally controlled by a single entity: COTI.

Of the live deployments of Djed at the time of writing, Djed powered by COTI is the largest Djed-based stablecoin by absolute TVL. It is also the largest stablecoin by TVL on Cardano.

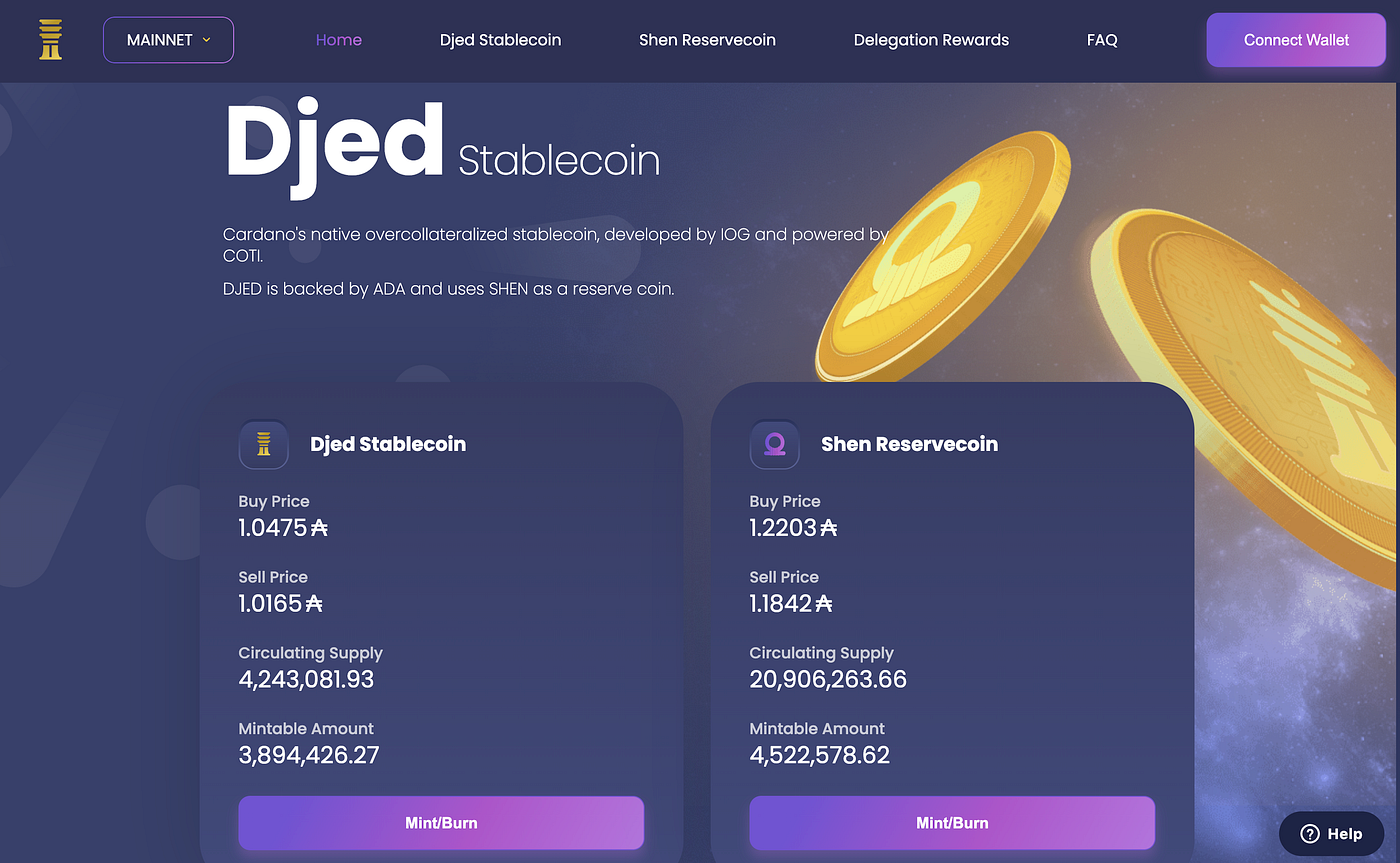

At the time of writing, these are the parameters of this deployment of Djed:

Peg: USD

BaseCoin: ADA

Fee: 1.5%

Minimum Reserve Ratio: 400%

Maximum Reserve Ratio: 800%

Operator Fee: 25 ADA

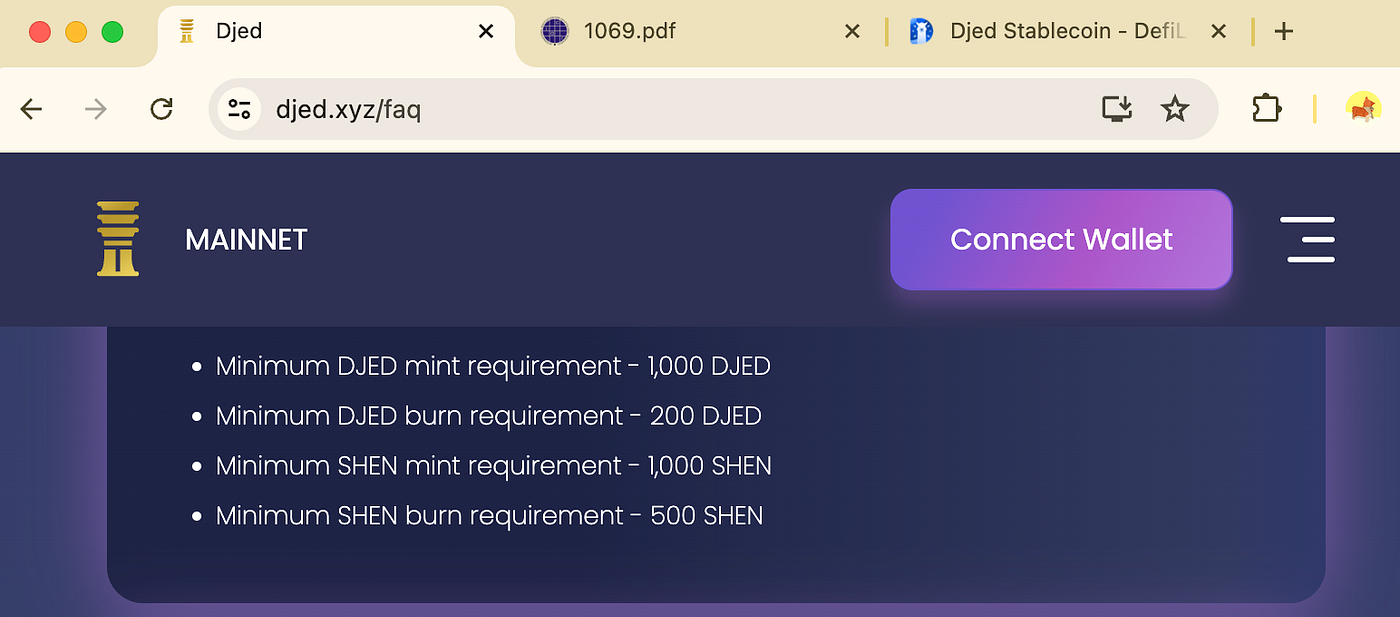

Minimum Transaction Limits:

Buy SC: 1000 SC

Sell SC: 200 SC

Buy RC: 1000 RC

Sell RC: 500 RC (Enforced at the UI.)

It is believed that the oracle has the following characteristics:

It is operated by COTI.

It relies on more than 6 data sources.

Sources are checked every 15 minutes.

Outliers are removed if the prices they provide differ from the median of the 6 prices by more than a parameter currently set to 0.06%. If more than 3 sources remain, the median of their prices is computed, signed and made available by the operator.

The signed price remains valid for 15 minutes.

Challenges and Improvement Opportunities

As mentioned above, COTI controls the oracle, the transaction batcher and the upgrades to the contract. COTI essentially operates the stablecoin. Even though Djed was designed to be autonomous (which literally and etymologically means "self-ruling"), this particular implementation is ruled by, operated by, COTI. Thus, this is a distortion of the Djed stablecoin protocol that harms the reputation of the authors of the protocol and violates their moral right of integrity and attribution. Most importantly, this central control entails a significant risk for the Cardano community.

Centralization Risks

The main advantage of an algorithmic (crypto-backed or crypto-collateralized) stablecoin based on smart contracts, in comparison with a fiat-backed stablecoin, is to not have to depend on an operator. And for the sake of this advantage, users are even willing to accept disadvantages such as capital inefficiency or higher minting and redemption fees. But, in the case of Djed powered by COTI, the disadvantages of fiat-backed and crypto-backed stablecoins are combined.

Like in a fiat-backed stablecoin, whose operator could run away with all the reserve, COTI can in principle upgrade the contract and give itself the right to move all the reserve to its own addresses. Like in a fiat-backed stablecoin, whose operator could prevent users from minting and redeeming, COTI could do the same by stopping the operation of the oracle and of the transaction batcher. COTI is also capable of knowing oracle prices in advance and may use this to its advantage. And COTI could even manipulate the oracle price to its advantage.

Even if one trusts COTI not to do the malicious actions described above, there is the possibility of COTI being hacked by malicious actors who would. So, centralization also results in a loss of security. Without a centralized operator, there would be no operator who could get hacked.

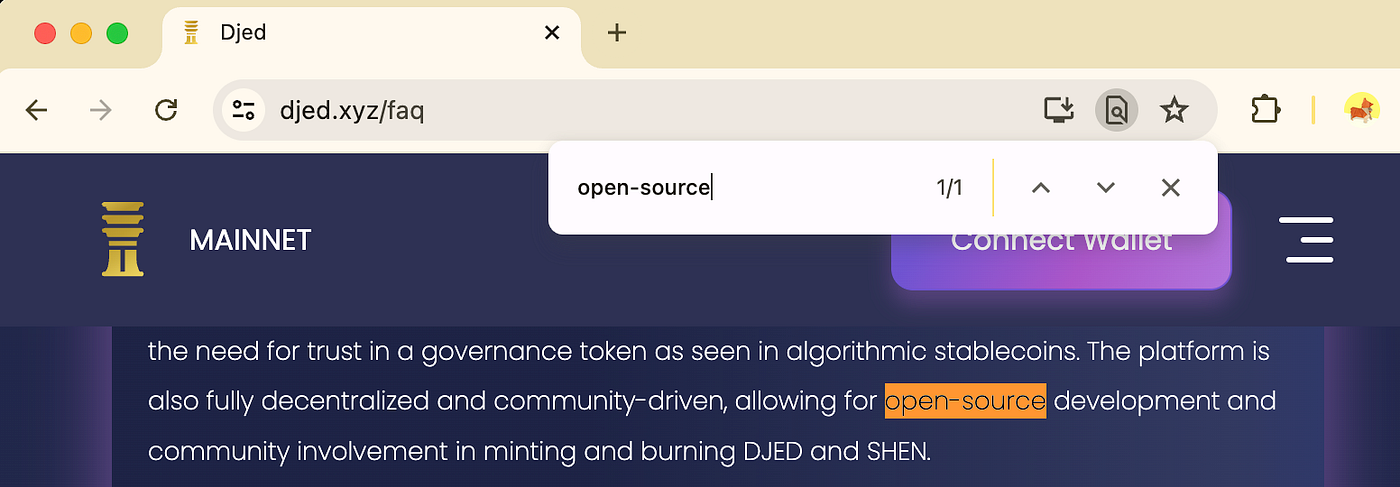

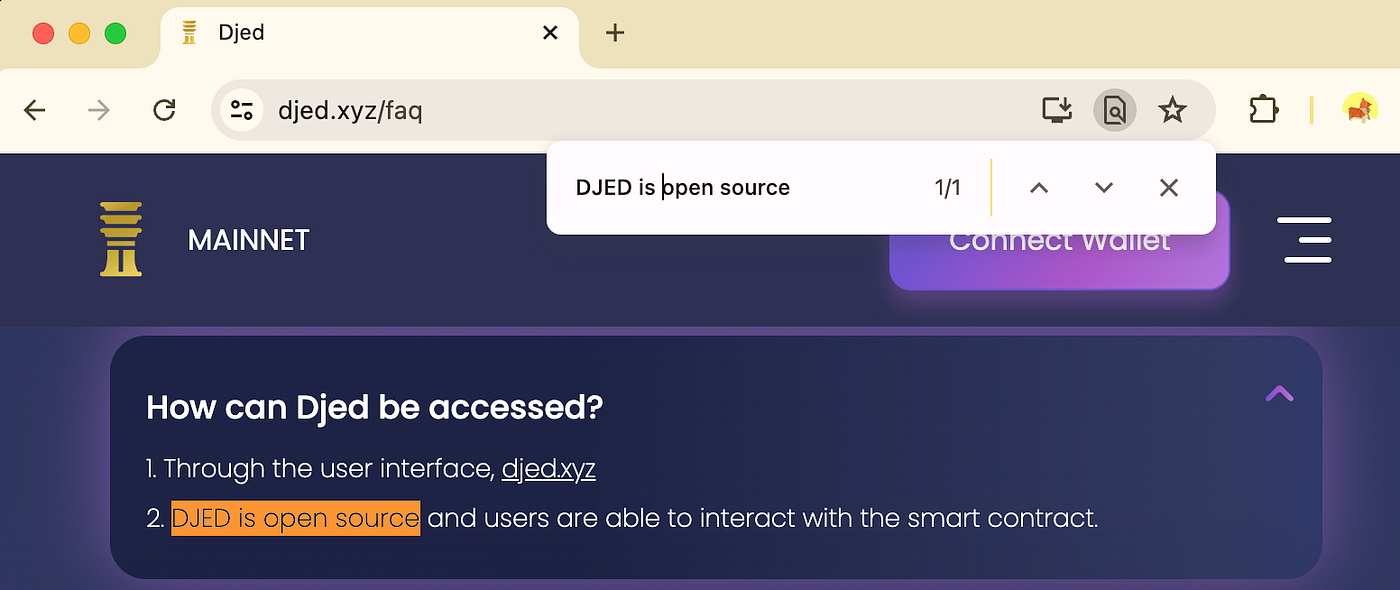

Closed and Unavailable Source Code

The implementation is not open-source (in the sense of being licensed through an open-source license). Worse yet, the source code is not even available for inspection. Therefore, users cannot do their own research to know whether they trust the smart contract that they are planning to interact with. They cannot know whether it is really an implementation of Djed, for instance. They cannot know whether there are discrepancies between the abstract Djed Stablecoin Protocol and this particular deployment. They must believe that the contract does what COTI claims it does. Even if one trusts COTI, it is natural to wonder: what is the point of using smart contracts at all then?

Transparency

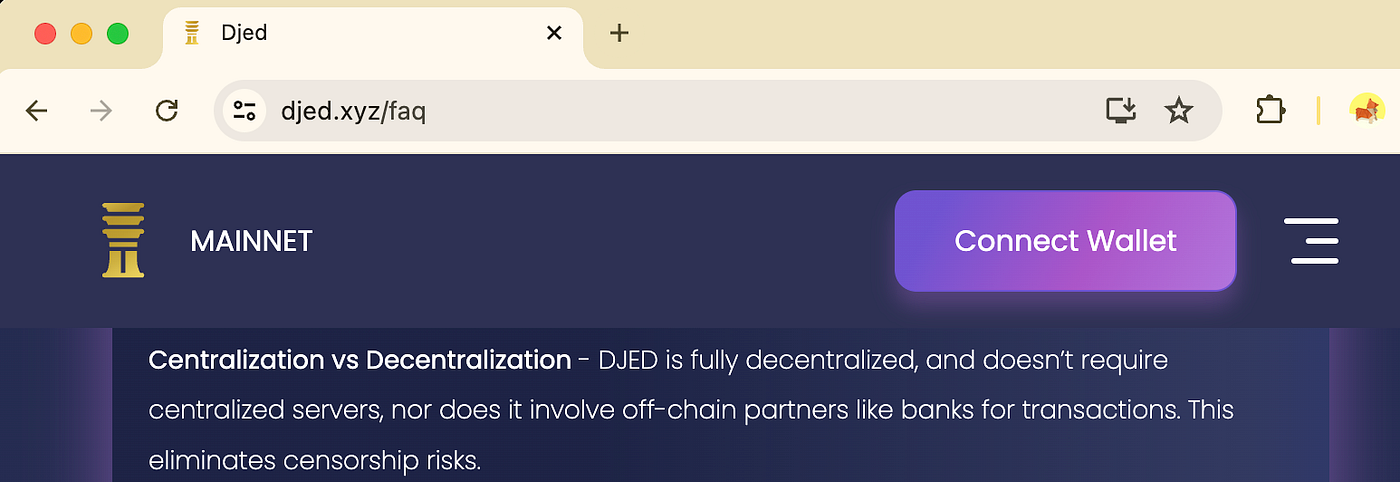

Instead of being transparent about the issues above, COTI either avoids these issues or deliberately claims the opposite of the truth. For example, as shown in the screenshots below, COTI's FAQ claims that Djed powered by COTI is decentralized and open-source.

Technical Misconceptions in the Documentation

COTI's FAQ is full of technical misconceptions and misunderstandings about the Djed Stablecoin Protocol itself. For example, COTI refers to Djed as "an overcollateralized stablecoin and not an algorithmic stablecoin".

But the title of Djed's paper states that Djed is algorithmic and the "Related Work" section of the paper explains how a crypto-backed stablecoin protocol, like Djed, differs from crypto-collateralized stablecoin protocols.

Outdated Djed Version

By the time Djed powered by COTI was launched, based on the Minimal version of the Djed Stablecoin Protocol, SigmaUSD had already been running for more than two years based on the same version. Despite SigmaUSD's success, those two years gave us many ideas for improvements, which led to the Osiris and Shu versions of Djed, to Dexy, to Gluon…

So, whereas the Minimal version of Djed is fine, it is already not the best version available out there and this was already known back when Djed powered by COTI was launched.

Rent-Seeking Fee and Free-Riding

Another consequence of having an operator for a protocol deployment that was designed to be operator-free is that this operator will have operational expenses that will need to be paid somehow. So, not only users get the disadvantages of centralization, but also have to pay more for these disadvantages.

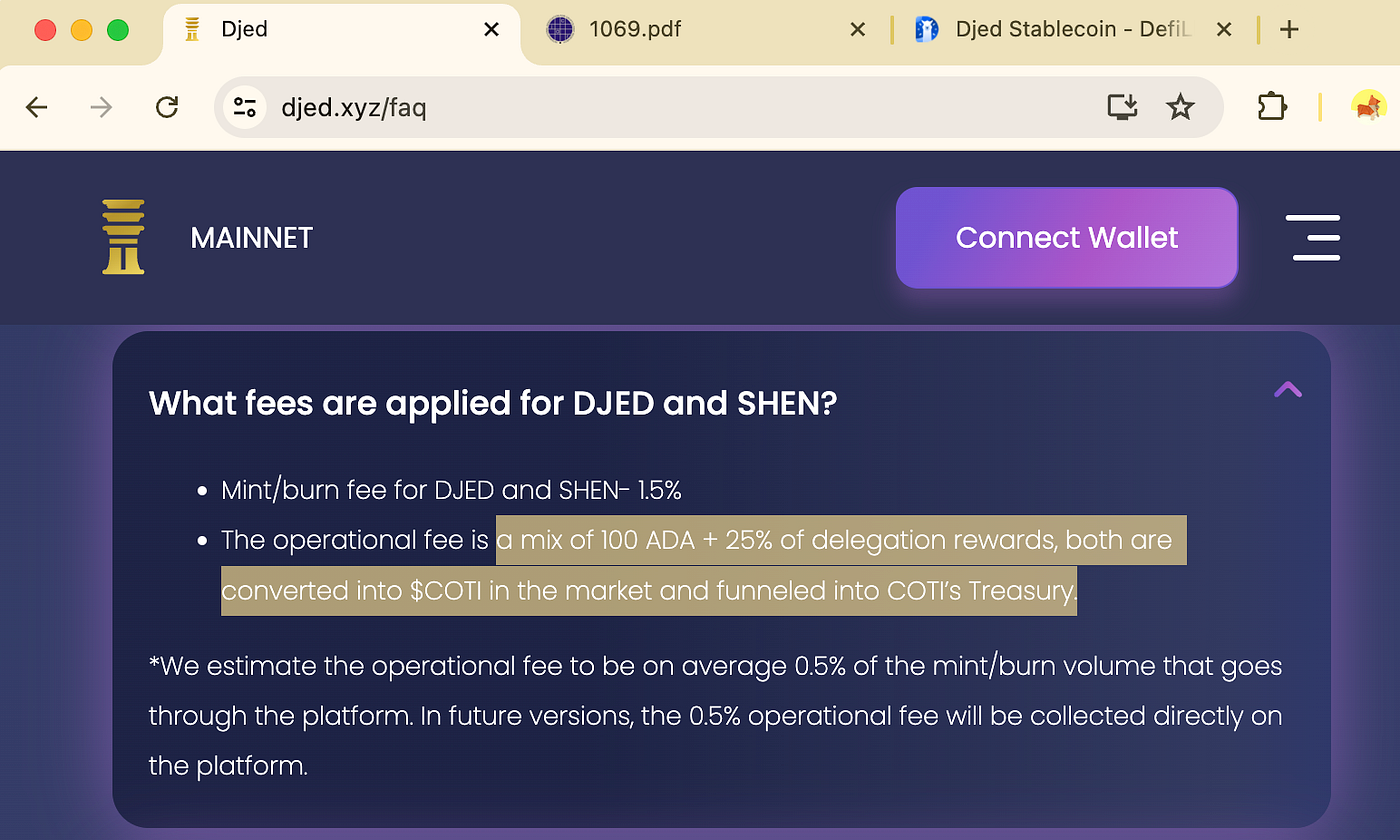

COTI funds its operations with an "operational fee [that] is a mix of 100 ADA + 25% of delegation rewards". These fees are not part of the original Djed Stablecoin Protocol.

A 25% fee on delegation rewards is a lot! If users need to choose between keeping their ADA in their own wallet earning 100% of staking rewards and depositing their ADA in a centrally controlled contract and receiving only 75% of staking rewards, why should they choose the latter? Clearly, this is a barrier for adoption by the Cardano community.

Furthermore, COTI explains that “both [fees] are converted into $COTI in the market and funneled into COTI’s Treasury”.

This means that COTI is consistently dumping ADA and pumping its own token, which is the native currency of a blockchain that is not Cardano.

Lack of Financial Inclusion and Permissionlessness

A key use case for stablecoins is financial inclusion: to give everyone, without the need for permission, access to a stable currency, no matter where they live and how rich or poor they are.

COTI's frontend for Djed powered by COTI restricts users from some countries. And, because COTI is the only centralized transaction batcher, such users can't even interact directly with the contract without using COTI's frontend.

Moreover, COTI imposes quite high minimum amounts to mint and redeem stablecoins and reservecoins. This effectively limits access to the contract only to wealthier users. Poorer users must resort to buying and selling stablecoins and reservecoins in secondary markets.

It pains us to see that a protocol that we designed to be financially inclusive and permissionless has been deployed in ways that are contrary to these ideals. But, beyond ideals, such restrictions also hinder and hold back adoption of Djed powered by COTI on Cardano.

Conclusions

The good news is that many of the issues described above should be easy to solve. Or, when this is not the case, it should be at least easy to give a clear and convincing explanation to the Cardano community.

Many cardano community members have raised exactly some of these issues in various forums and they remain unanswered by COTI. The Cardano community has now funded a Catalyst project where one of the deliverables is this documentation page. Hopefully this documentation page, funded by the Cardano community, will lead COTI to listen and trigger improvements in Djed powered by COTI and bring even more success and adoption for Djed powered by COTI. Such improvements would also be beneficial for the reputation of the Djed Stablecoin Protocol as a whole and for Djed-based stablecoins that are part of the Djed Alliance.

Last updated